Superstardom and Dark Matter

How and when does an NBA player transcend from being simply an elite athlete to the near-mythical status of “superstardom”? With the obvious exception of LeBron James who was anointed a basketball King in his freshman year of high school, it is rarely obvious when this transition is happening. In retrospect, we can convince ourselves that the signs were there, but in truth there are many contributing factors that must come into alignment at just the right time for a player to emerge as a superstar. The multi-dimensional nature of superstardom makes it difficult to see as it is crystallizing. The elements that come together to form a superstar are a function of both on-court performance and off-court factors. When we have a superstar on our hands, these elements combine to form something that is greater than the sum of the individual parts.

Through the lens of a recovering rocket scientist, the alchemy of superstardom looks awfully like dark energy or dark matter – something that we do not have a descriptive framework for, but is pervasive and has very tangible effects that cannot be explained in its absence. Today, we at Fansure have made significant strides in peering behind the curtain of superstardom and quantified it with the Fansure Player Index. Solving the grand challenges of astrophysics will be left to our good friends over at NASA.

The Fansure Player Index

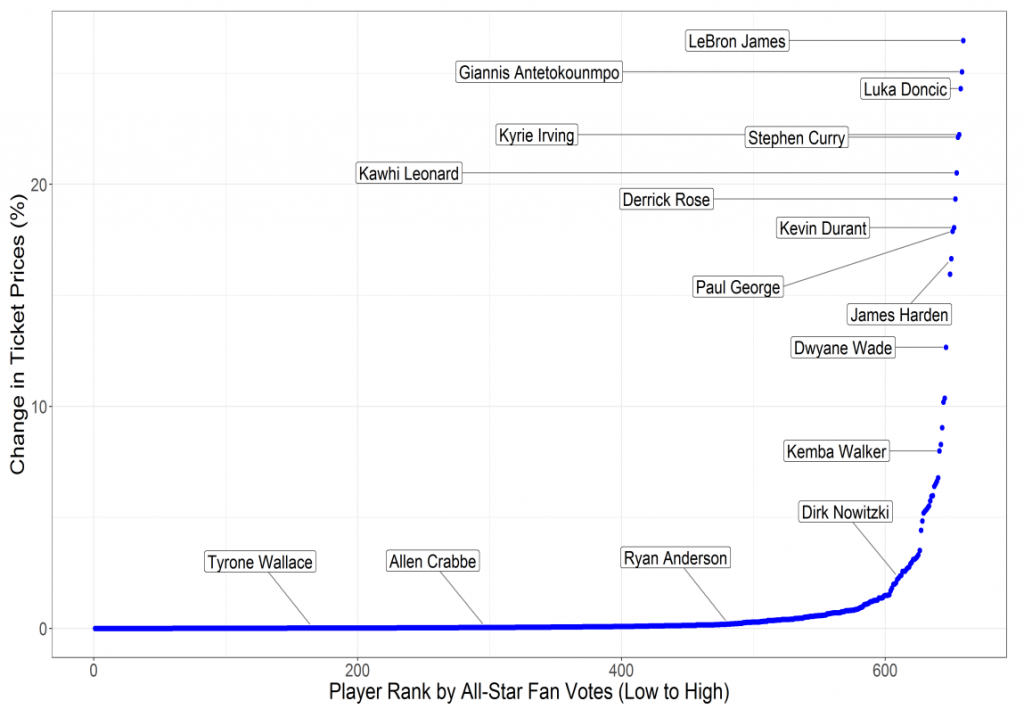

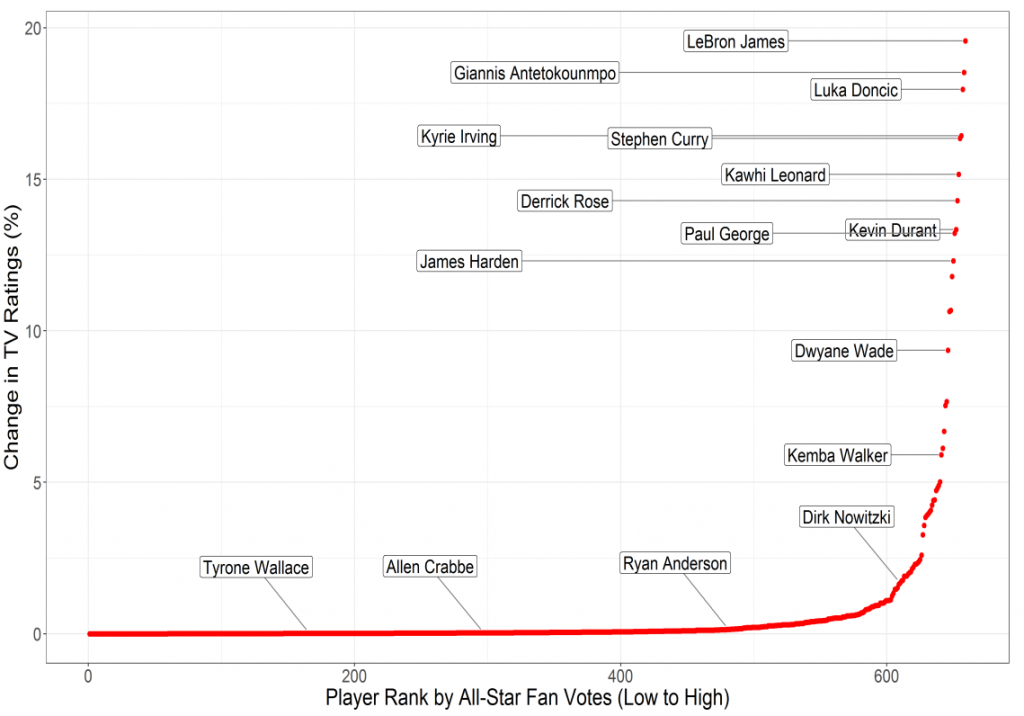

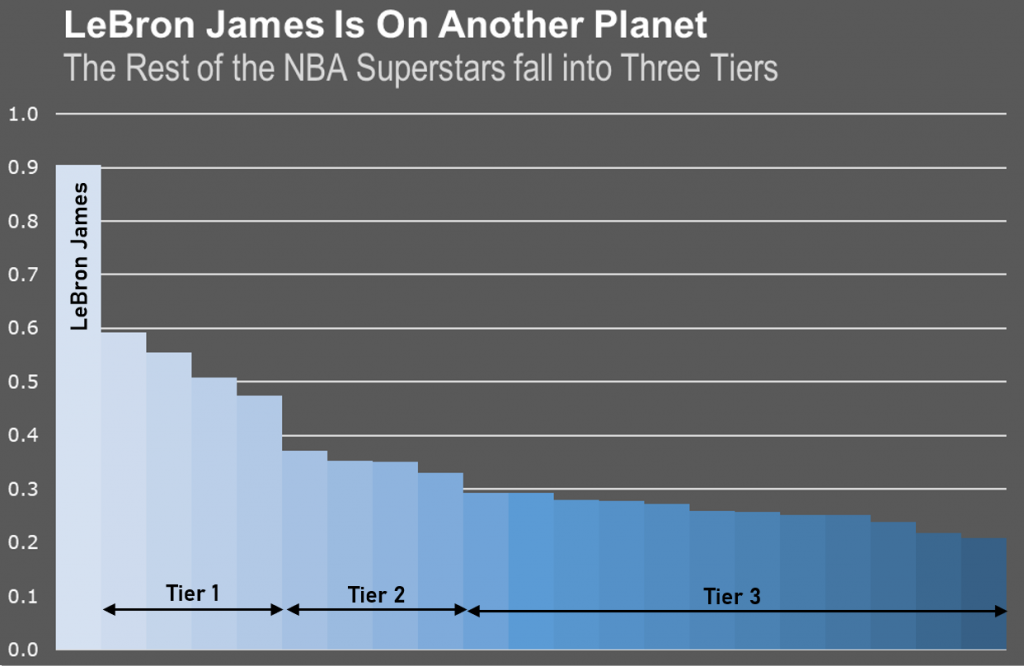

There is body of literature describing the observed economic effects of superstars [1-3]. Some of the most recent work in this area comes from our very own Scott Kaplan who has measured the impact of superstar popularity on secondary market ticket prices and Nielsen ratings (Figure 1). This research indicates that there are clearly a few tiers of players and only those in the upper echelon can individually move the needle for fans – as measured by ticket prices and viewership ratings.

What we are doing here is looking upstream of these end results to propose a metric that attempts to capture the contributing factors that generate a superstar and quantifies them through the Fansure Player Index. The direct on-court metrics which feed into the Fansure Player Index include a handful of well-known advanced metrics: John Hollinger’s Player Efficiency Rating (PER), ESPN’s Real Plus-Minus (RPM), Win Shares from Basketball Reference, and Game Score (also from John Hollinger). We synthesize all of these into one meta-advanced metric in an effort to balance out the imperfections of each statistic and get an average picture of the on-court contributions of each player.

In addition to the wonky advanced statistics, the Index also includes MVP odds and All-Star Votes. These factors are partially related to statistical performance, but also infuse some less tangible information into the Index regarding the perception of players. Finally, the Index includes fan-engagement related factors including the social media footprint. All of these metrics are rolled up into one number: The Fansure Player Index, where a “perfect” superstar is rated 100.

Future versions of the Index will include jersey sales to further inform the fan-engagement facet of superstardom and the number of “exciting” plays that a player creates (dunks, blocks, long-distance 3-pointers, for example) to add another dimension to the on-court performance of players.

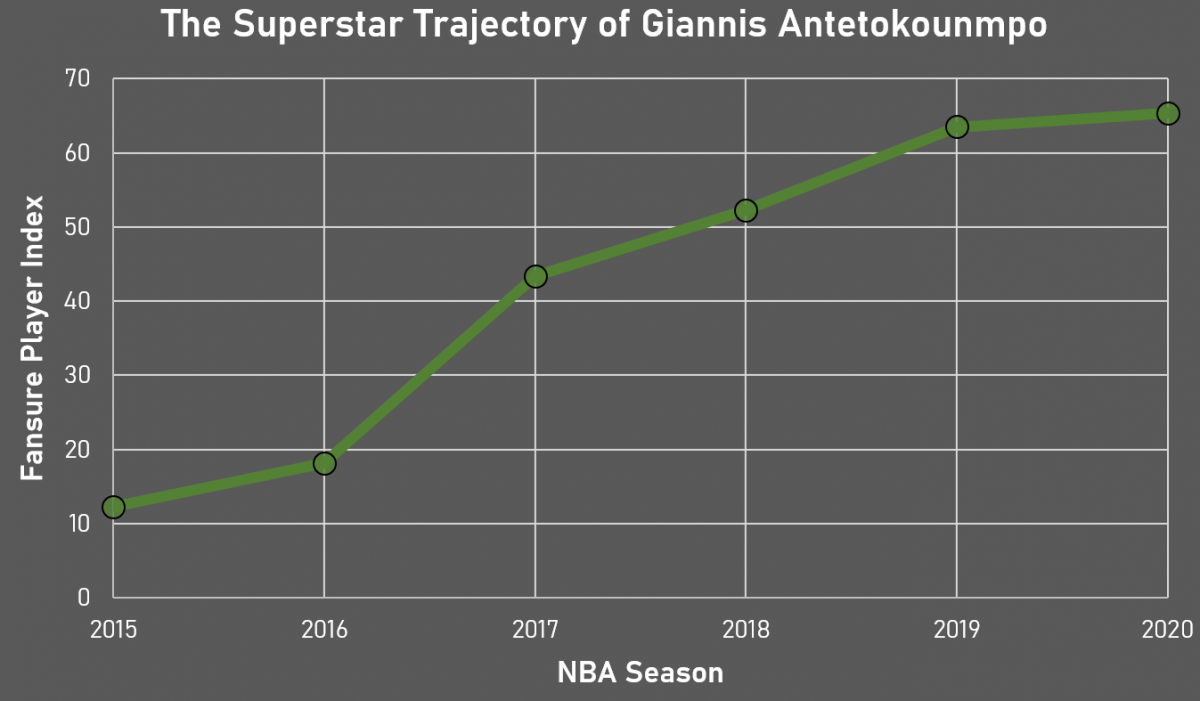

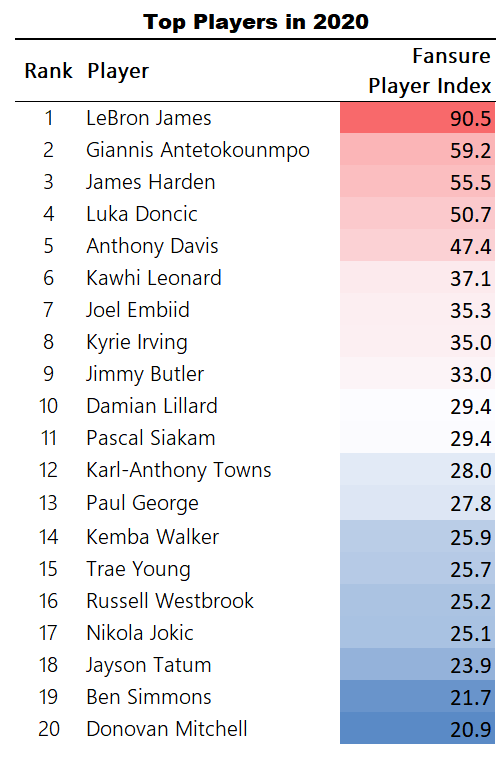

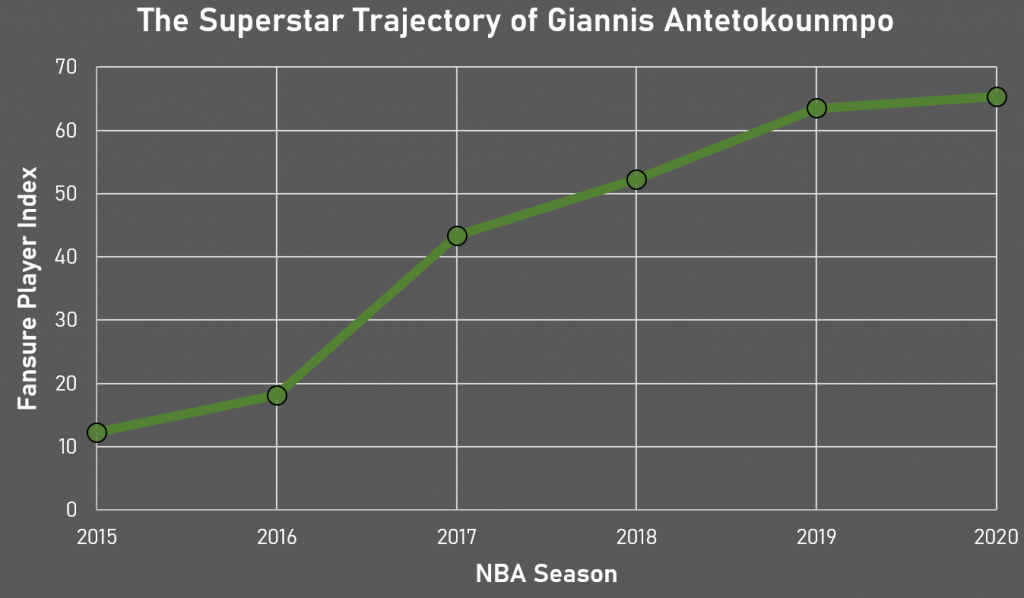

To nobody’s surprise, LeBron James is an absolute outlier. What is insightful here is to see the moat between him and the rest of the back quantified. When healthy, the second highest player on the Fansure Player Index is Stephen Curry (rated at 60.6 before the start of the season). With Curry injured this season, Giannis is holding down the second spot en-route to his second straight MVP caliber season. The steady climb of Giannis’ Index rating over the last five seasons is shown in Figure 2. Still, Giannis and Curry are closer to the 10th or 11th player on the list than they are to King James.

Beyond LeBron, there are clearly a few tiers of players as measured by the Index. The Tier 1 players appear to end with Anthony Davis at #5 and include those you would expect (Curry and Durant are in this tier when healthy), but also indicate just how quickly Luka Doncic has exploded onto the scene. In all likelihood Zion Williamson will find himself in this category in the very near future. A perhaps surprising omission from this top tier is Finals MVP Kawhi Leonard, who pays a pretty substantial superstardom price for not being on social media.

The second tier of superstars includes Kawhi, Joel Embiid, Kyrie Irving, and Jimmy Butler. Beyond that, there is a relatively slowly decreasing cascade of players which, rounding out the top 20 players, we will call Tier 3.

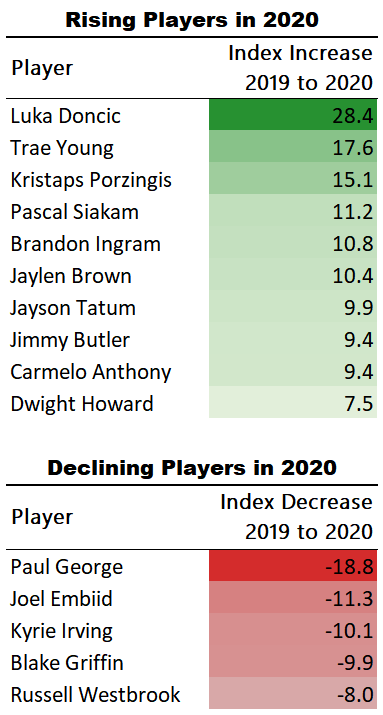

Comparing the Index of players from last season to this season, we see that some of the biggest increases belong to the younger generation of players who are starting to shine and those who are experiencing resurgence years (Porzingis, Carmelo Anthony, and Dwight Howard). Despite having an impressive first season with the Clippers, Paul George has regressed from his near-MVP season last year, due in part to the injury he dealt with at the beginning of the season. As such, his All-Star vote totals and advanced statistics have taken a pretty appreciable step backward this season and, after being ranked as high as #6 last year, he has fallen to #13.

Summing It All Up

Fansure is a sports analytics company focused on predicting player availability that provides a variety of insights and services related to this core competency. In an effort to better understand the star players that dominate the NBA market we have developed a metric quantifying superstardom called the Fansure Player Index. This tool is being used to provide insights to everyone that is affected when superstar athletes are unavailable: fans, ticket retailers, teams, TV networks, fantasy sports participants, and the sports betting sector. We also use the Fansure Index to define the “top” players in our portfolio for our ticket protection product which provides fans a way to protect their in-game experience when their favorite player is absent and is live today at fansure.com.

Be sure to check back in after the final All-Star vote tallies have been announced when we will provide another update and also tell you about how we can measure franchise value using the cumulative contributions of the players on the court in addition to a similar index metric for team-related factors.

References

[1] Hausman and Leonard 1997, [2] Humphreys and Johnson 2017 [3] Kaplan 2020